ANLAGE DIAMANTEN

Schön und selten

Aufgrund des steigenden Interesses an Diamanten verbunden mit einem Anlagegedanken, haben wir hier alles Wissenswerte rund um das Thema Anlage Diamanten für Sie zusammen gestellt. Nicht nur die Preise beim Juwelier und das Marketing der Schmuckbranche legen die Idee von Diamanten als Wertanlage nahe. Auch regelmäßige Nachrichten über der Verkauf von größeren Diamanten bei Sotheby´s (100,2 Karat Diamant im Smaragdschliff) oder Christie´s (Blauer 101,73 Karat Diamant) zu astronomischen Preisen zeigen die Nachfrage nach den besonderen Steinen. Und aktuell erholt sich die Branche bereits wieder nach dem Corona-Schock gemäß dem globalen Bain-Report.

WARUM DIAMANTEN ALS WERTANLAGE?

- Inflationsschutz als Sachanlage

- Stabile Wertentwicklung

- Anlage Diamanten weltweit handelbar

- Hohe Wertkonzentration

- Hohe Mobilität

- Keine Erhöhung von Steuern und Abgaben seitens des Fiskus möglich

- Wenige große Firmen kontrollieren die Produktion und damit das Angebot von Diamanten

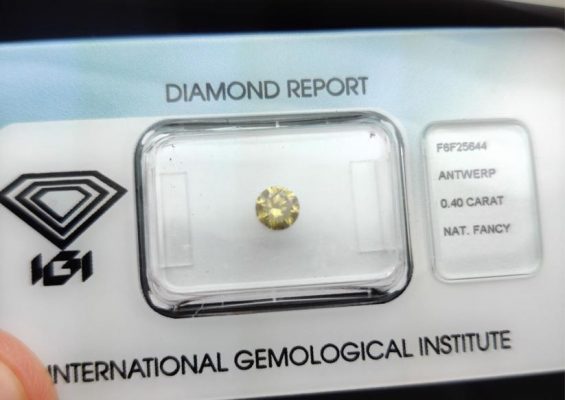

Zertifizierte Diamanten

Unabhängige Bewertung

ANLAGE DIAMANTEN UND INFLATION

Wie andere Sachanlagen eignen sich Diamanten als Inflationsschutz. Neben der stabilen Wertentwicklung über die Jahrzehnte macht die hohe Wertkonzentration die Aufbewahrung leicht und die Wertanlage sehr mobil. Im Vergleich zu Immobilien, deren Werte nicht transportiert werden können, bestehen keine Abhängigkeiten an die Örtlichkeit – Diamanten sind international handelbar.

Auch kann der Fiskus nicht nach Belieben die Steuern und Abgaben erhöhen, die unweigerlich die Rendite einer Immobilienanlage schmälern. Im Vergleich zu Gold sind Werte in Diamanten wesentlich leichter zu transportieren: 1 kg Gold kosten derzeit ca. 35.000 EUR. Der gleiche Wert wird auch schon von Diamanten zwischen 1 und 1,5 Karat (0,2 bis 0,3 Gramm) in den entsprechenden Qualitäten gehalten.

Obwohl De Beers heute keine Monopolstellung mehr im Diamanthandel hat, sind doch nur wenige große Firmen in der Produktion von Rohdiamanten etabliert. De Beers und ALROSA zusammen sind verantwortlich für ca. 70% der Förderung von Rohdiamanten. Sollten die Diamantenpreise fallen, liegt es im eigenen Interesse dieser Firmen das Angebot zu beschränken und so die Preise gegebenenfalls aufzufangen. Deswegen ist das Marktumfeld beim Thema Anlage Diamanten ebenfalls eine wichtige Größe.

5 ct. Diamant

Ein Fünfkaräter wiegt 1 Gramm

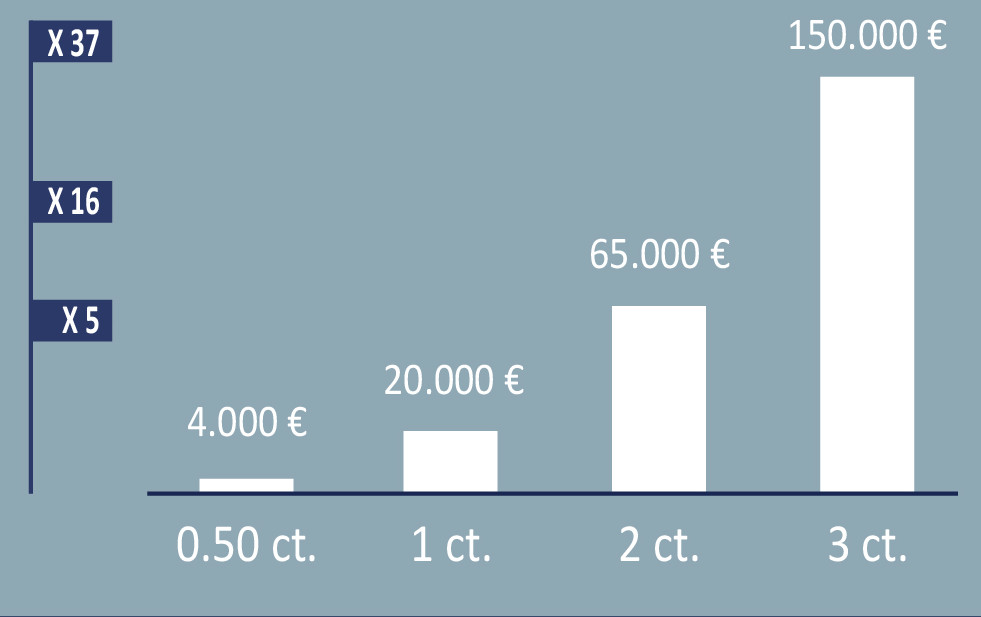

Karatgewicht und Preis

PREISGEFÜHL

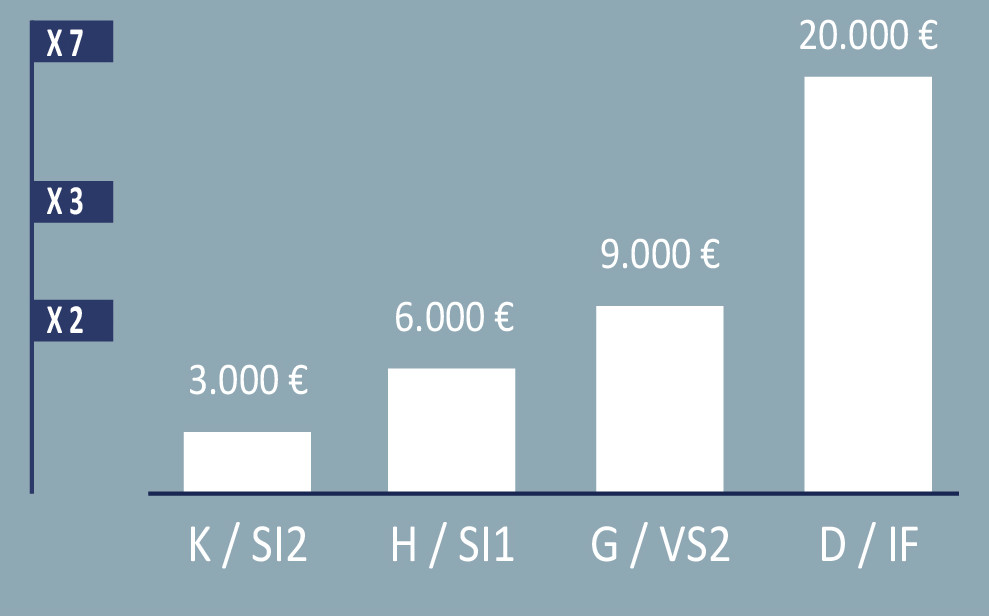

Kleinste Unterschiede in der Qualität machen große Unterschiede im Preis von Anlage Diamanten aus. Entsprechend gut sollte man sich wie bei jedem Investment vorab informieren über mögliche Chancen und Risiken sowie was Sinn macht und was nicht. Von der Historie lässt sich zwar nicht auf die Zukunft schließen, trotzdem haben wir weitere Informationen über Diamantpreise für Sie zusammengefasst.

Qualität und Preis 1 ct.

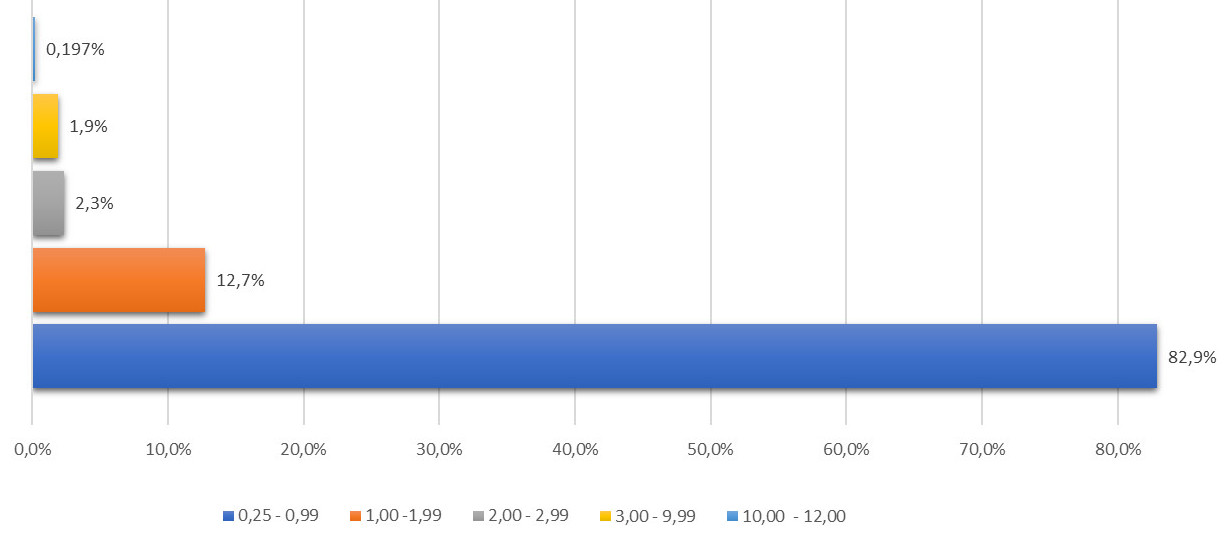

Verfügbarkeit nach Größe

FÜR WEN EIGNEN SICH DIAMANTEN ALS INVESTMENT?

Anlage Diamanten eigenen sich, wenn Sie verschiedene Qualitäten in ihren Investments suchen:

- Sie möchten ein langfristiges Investment tätigen und suchen nicht den schnellen Kursgewinn

- In erster Linie ist Ihnen an einem krisensicheren Werterhalt gelegen

- Sie haben bereits ein diversifiziertes Anlageportfolio

- Ihr Investment muss keine regelmäßigen Dividenden oder Ausschüttungen abwerfen, auf die Sie angewiesen sind

- Sie haben sich über Diamanten und den Diamanthandel informiert und wissen, dass Schmuck so alt ist wie die Menschheit selbst

- Wie andere alternative Investments in Oldtimer, Kunst oder Wein haben Sie eine Affinität zu Schmuck und Edelsteinen. Der Besitz dieser brillanten Assetklasse ist für Sie mehr als nur eine Anlage

Diamantring über 9 ct.

Kissen-Schliff für 100.000,- EUR

Der größte ROI (return on investment): Ihrer Frau eine Freude bereiten. Sie können Diamanten jederzeit in Schmuck fassen lassen und als solchen auch verwenden – tiefer kann man bei diesem Investment nicht fallen.

MÖGLICHE NACHTEILE

Obwohl Anlage Diamanten jederzeit Verwendung im Schmuck finden können, gilt es trotz vieler Möglichkeiten auch potentielle Risiken zu bedenken.

Komplexe Materie. Es ergeben sich große Preisunterschiede durch die verschiedenen Parameter und Qualitäten und ein Einkaräter ist nicht gleich ein Einkaräter.

Keine Spotrate. Im Gegensatz zu Gold gibt es bei Anlage Diamanten keine „Spotrate“ bzw. einen festen Kurs an der Börse. Daher gilt es vorab prüfen was sich als Investment eignet. Unterschiedliche Größen und Qualitäten entwickeln sich auch unterschiedlich im Preis. Manche Steine werden als Anlage Diamanten gepriesen, sind es aber nicht.

Was sind Anlage Diamanten und was nicht? Farbdiamanten sind schwer zu vergleichen.

Im Schmuck etwas Besonderes, aber als Anlage nicht geeignet: Diamant Herz

Mehrwertsteuer. Diamanten unterliegen der gesetzlichen Mehrwertsteuer. Das heisst, bei der Liquidation Ihrer brillanten Assets an Privat können Sie diese auch aufrufen. Beim Verkauf in den Handel verlieren Sie Ihre gezahlte Umsatzsteuer. Gerne helfen wir bei der Vermittlung an einen Diamantliebhaber oder machen Ihnen selbst ein Angebot zum Ankauf.

Zeitrahmen. Kurzfristige Investments schließen sich nicht nur aufgrund der oben genannten Mehrwertsteuer aus. Diamantpreise wachsen stetig, aber langsam. Jedes Prozent Inflation über die Jahre arbeitet für Sie und die Wertsteigerung Ihrer Anlage Diamanten.

MÖGLICHKEITEN UND STRATEGIEN

Die meisten Kunden verfolgen eine von zwei Anlagestrategien:

I. Sie kaufen Diamanten in kommerzieller Qualität, für die eine hohe Nachfrage besteht.

II. Sie kaufen Diamanten in den höchsten und seltensten Qualitäten.

Bei beiden Strategien für Anlagediamanten sollten Sie folgende Parameter beachten:

- Brillanten sind die beliebtesten Diamanten. Die runde Brillantform wird in über 75% Fällen vom Kunden gewählt.

- Gefragte Größen: 0,5 Karat 0,75 Karat 1 Karat 1,25 Karat 1,5 Karat 2 Karat

Die meisten Diamantliebhaber entscheiden sich für eine der oben aufgeführten Größen. - Keine Fluoreszenz. Auch wenn viele Käufer begeistert sind von dem Phänomen Fluoreszenz und manche Steine sogar dadurch aufgewertet werden (mehr dazu), straft der Diamanthandel fluoreszierende Diamanten mit einem Discount ab. Halten Sie sich beim Anlagegedanken daran.

- GIA Zertifikat. Andere Zertifikate können gleichwertig sein, trotzdem empfehlen wir Ihnen hier die Wahl eines Zertifikats des Gemological Institute of America.

Brillanten in beliebten Größen

Keine Fluoreszenz

STRATEGIE I

Richten Sie Ihr Diamant-Portfolio nach überdurchschnittlichen, nicht jedoch den höchsten Qualitäten aus. Konkret bedeutet das:

| Karatgewicht: 0,50 bis 2 Karat | Schliff: Sehr gut – exzellent |

| Farbe: H – G – F | Politur: Sehr gut – exzellent |

| Reinheit: VS1 – VS2 | Symmetrie: Sehr gut – exzellent |

Diese Kombinationen sind immer gefragt und finden Verwendung im Schmuck. Jeder Juwelier kann diese Diamanten gebrauchen und die Wahrscheinlichkeit, einen privaten Käufer zu finden, ist vergleichsweise hoch.

STRATEGIE II

Richten Sie Ihr Diamant-Portfolio nach den höchsten Qualitäten aus:

| Karatgewicht: 1 bis 3 Karat | Schliff: Exzellent |

| Farbe: D – E | Politur: Exzellent |

| Reinheit: FL – IF | Symmetrie: Exzellent |

Diese Qualitäten sind von Natur aus selten, hochpreisig und wertbeständig. Die potentielle Käufergruppe ist zwar im Vergleich zur ersten Strategie kleiner, was das Investment bei Liquidation langatmiger macht, dafür ist der Wertzuwachs bei größeren Steinen in höheren Qualitäten auch kräftiger. Weil der Begriff Anlagediamant in diesem Bereich sehr eng definiert ist, macht es den Handel vergleichbar und die Preise lassen sich leicht verfolgen.

Aber der Wald besteht nicht nur aus den höchsten Bäumen:

Grundsätzlich entscheidet sich die Qualität jeder Anlage – ob Diamanten, Gold oder Aktien – beim Verkauf. Wenn Sie einen Diamanten mit anderen Parametern als oben genannt günstig kaufen und gewinnbringend verkaufen, ist das ebenso ein gutes Investment.

ANLAGEDIAMANTEN VON DIAMANT AGENTUR

Warum Sie sich für die Abwicklung bei Diamant Agentur entscheiden

- Umfangreiche Expertenberatung gemäß unserem Grundsatz:

„Der informierte Kunde trifft die bessere Kaufentscheidung“ - Diamanten werden mit GIA Zertifikat sowie Lasergravur der Zertifikatsnummer geliefert. So können Sie den Diamanten zu jeder Zeit eindeutig dem Zertifikat zuordnen. Wir zeigen Ihnen bei der Abholung wie das geht.

- Garantiert bester Preis durch Zugang zu internationalen Diamantbörsen mit über 1,5 Milllionen Diamanten im Angebot (mehr dazu)

WOVON WIR ABRATEN

Diamanten, die als Schmuckstein bestens geeignet sind, können unter Umständen keine gute Anlage sein. Beispielsweise ein stark fluoreszierender Diamant in Tropfenform von 1,34 Karat mit niedrigem Farbgrad. Oder ein bräunlicher Diamant in Cushion Form. Dieser mag in einem Schmuckstück wunderschön aussehen, kann jedoch schwierig weiterzuverkaufen sein. Anlagediamanten sollten zertifiziert und vergleichbar sein.

Gleiches gilt für andere Liebhaber-Stücke:

Sehr große oder farbige Diamanten – mit die teuersten Edelsteine – sind zwar sehr wertvoll, aber nicht leicht zu verkaufen. Umso spezieller das Design des Schmuckstückes oder umso mehr die Farbe vom Mainstream Geschmack und Markt abweicht, desto langwieriger gestaltet sich der Wiederverkauf. Entsprechend eignen sich solche Steine in der Regel nicht zur Anlage.

HINWEIS

Die Informationen auf unserer Webseite stellen keine Anlage- oder Finanzberatung dar. Die Daten und Statistiken zum Thema Diamant vor dem Hintergrund des Investitionsgedankens dienen lediglich informativen Zwecken. Der größte ROI (return of investment) ist es, die Dame Ihres Herzens mit einem Diamanten oder Diamantring eine Freude zu bereiten.