DIAMANTPREISE

Endlich verständlich erklärt

Was kostet ein Diamant?

Gold hat einen Grammpreis, der US-Dollar hat einen Börsenkurs. Bei Diamanten bestimmt die Qualität den Wert – und dabei machen kleine Nuancen große Unterschiede im Preis. Im Folgenden zeigen wir wie man Diamantpreise sinnvoll vergleichen kann.

Zudem haben wir für Sie historische Daten zusammengestellt, Informationen über aktuelle Entwicklungen und Hintergrundwissen aus dem Diamantmarkt. Sie bekommen ein besseres Verständnis für die Preisdynamik im Diamanthandel und vor allem auch ein Preisgefühl.

Wichtig gleich vorneweg:

Auskünfte über die Vergangenheit können wir geben. Vorhersagen über zukünftige Entwicklungen sind Spekulation. Eine Anlageberatung können wir nicht machen, die Zusammenstellung aller Daten und Statistiken dient lediglich zu Informationszwecken.

Inhaltsverzeichnis:

Marktcheck Januar- Angebote vom 31.01.2024

(GIA / 3x "exzellent" / keine Fluoreszenz)

16 T€

58 T€

146 T€

439 T€

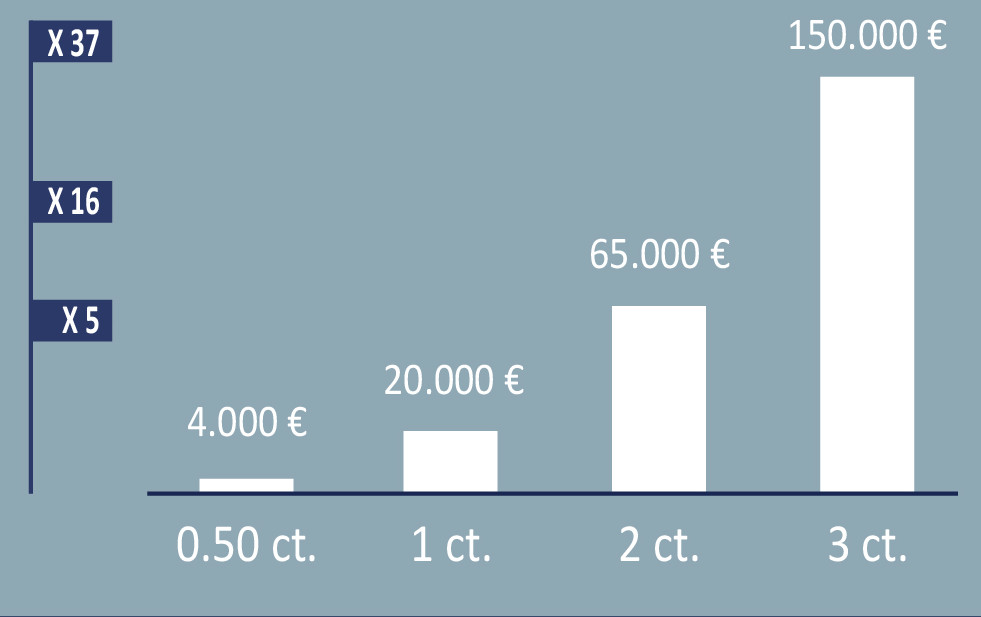

Karatgewicht und Preis

Die Preisentwicklung bei steigendem Karatgewicht und gleicher Qualität (D / IF) ist immens.

Je größer, desto seltener: Das zeigt sich in den Diamantpreisen: Der Einkaräter kostet fünf mal soviel wie der Halbkaräter, während der Zweikaräter bereits mehr als das 16-fache kostet.

Diamantpreise im Vergleich:

0,50 ct. / 1 ct. / 2 ct. und 3 ct.

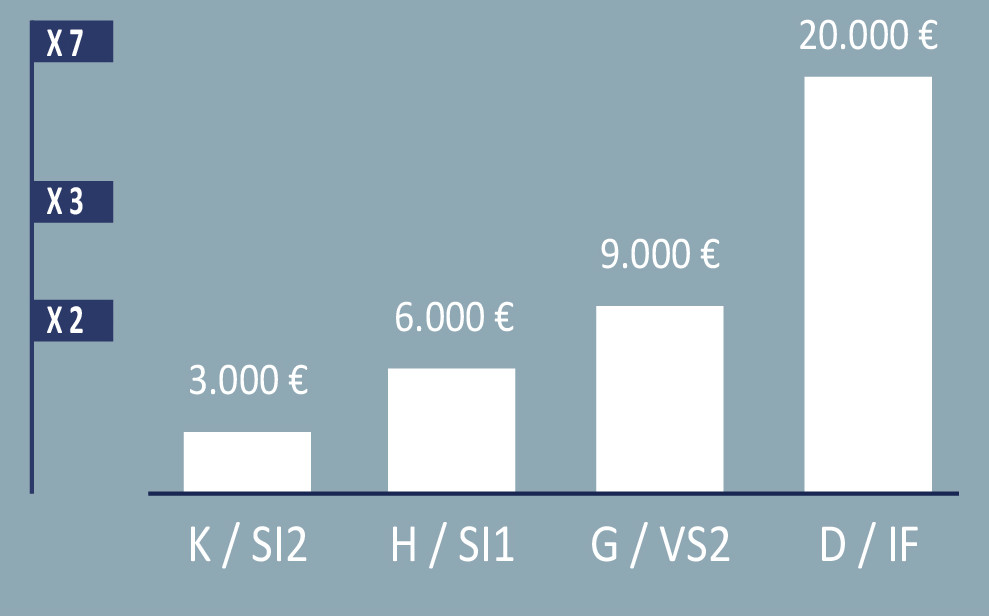

Qualität und Preis

Ein Einkaräter in mittelmäßiger Qualität kann je nach Schliff ca. 3.000,- Euro kosten. Bessere Qualität kostet schnell auch das Doppelte, Dreifache oder Siebenfache – bei gleicher Steingröße.

Diamantpreise im Vergleich:

Einkaräter nach Qualität

Rapaport diamant preise

Die Rapaport Diamant Preisliste ist eine von Martin Rapaport 1978 ins Leben gerufene wöchtentlich erscheinende Preisliste für Diamanten. Sie ist reserviert für Händler und Juweliere und hilft ihnen weltweit bei der Preisgestaltung von Diamanten für den Verbraucher. Die darin gelisteten Preise (in USD) dienen nur als Orientierungshilfe für Preisveränderungen. Sie sind keine festgelegten Preise. Es gibt keine Diamantenkurse oder etwa eine Spotrate an der Börse wie bei Gold.

An der Diamantenbörse werden die jeweiligen zertifizierten Diamanten nach dem Prinzip Angebot und Nachfrage gehandelt. Dabei werden die Preise in der Regel angegeben als Discount – prozentual von den jeweiligen wöchentlich aktuellen Diamantpreisen. Das bedeutet: Die Rapaport Preisliste ist für Verbraucher nicht wirklich hilfreich, wenn man nicht sieht welche prozentualen Rabatte am Markt derzeit gehandelt werden.

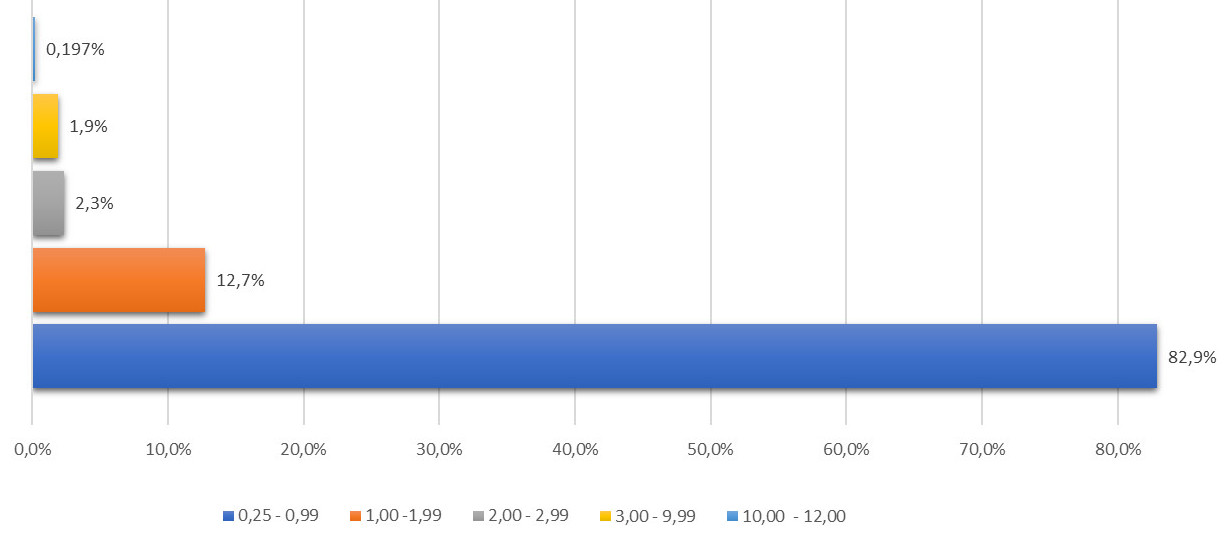

WAS IST SELTEN?

Die Verfügbarkeit von Diamanten in Schmuckqualität nach Karatgröße macht es deutlich: Die meisten Diamanten sind kleiner als 1 Karat (ca. 83%), während das Angebot bei steigender Größe knapper und knapper wird. Diamanten zwischen 1 und 2 Karat sind im Gesamtvergleich nur fast ein Zehntel der verfügbaren Steine. Bei Diamanten über 3 ct. sind es nur noch ca. 2% und bei Diamanten über 10 ct. ist man sogar im Promille-Bereich.

Nimmt man hierzu noch die oben beschriebenen Unterschiede in den höheren und höchsten Qualitätsstufen, wird die Auswahl nochmal um ein Vielfaches enger. Das ist Seltenheit.

Anzahl Diamanten gemäß Karatgewicht

JAHR ZU JAHR

Wie bereits oben beschrieben entwickeln sich die Diamantpreise je nach Größe und Qualität unterschiedlich. Die Aufstellung hier zeigt die aktuelle Veränderung vom letzten zu diesem Jahr nach Karatgewicht. Dabei wird der Durchschnittspreis der Marktpreise im oberen Bereich zu Grunde gelegt:

0,30 ct.

9,4 %

0,50 ct.

17,0 %

1,00 ct.

2,7 %

3,00 ct.

-1,5%

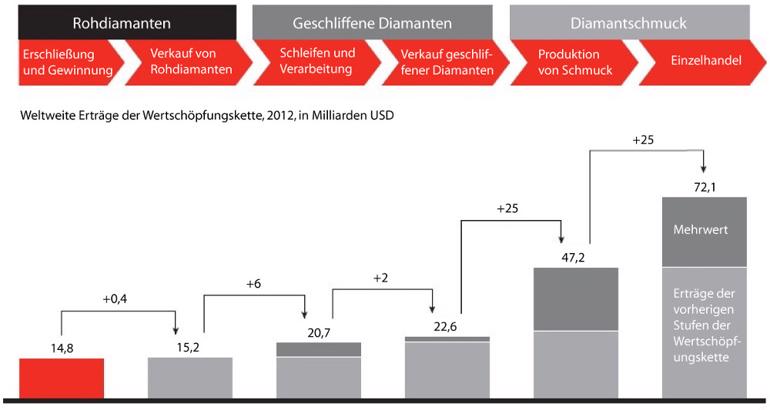

WER VERDIENT WIE VIEL?

Die klassischen Diamanthändler im Mittelmarkt, das heisst, zwischen den Minengesellschaften sowie „DTC Sightholdern“, den Schmuckfabrikanten sowie den Einzelhändlern, haben sehr geringe Margen von teilweise nur 1-2%. Verdient wird insbesondere bei der Schmuckverarbeitung und im Einzelhandel:

Quelle: IDEX, Tacy Ltd. und Chaim Even-Zohar

Mit freundlicher Genehmigung von Bain & Company

BRILLANTPREISE

Diamanten unterschiedlicher Form lassen sich am besten über den Karatpreis vergleichen. Dabei fällt auf, dass Brillanten am begehrtesten und teuersten sind. Die meisten Diamanten werden rund – im Brillantschliff – geschliffen (ca. 7 von 10 Diamanten). Die Verfügbarkeit ist am größten, aber auch die Nachfrage.

Entsprechend wird jeder Rohdiamant, wenn möglich rund geschliffen. Wenn der Rohdiamant eine ungünstige Form hat (länglich) oder gravierende Einschlüsse an der falschen Stelle hat, kann durch eine andere Schliffform oft ein höherer Diamantpreis (pro Karat) erzielt werden. Deswegen sind Fantasieschliffe meist für den Liebhaberbereich und bilden eine Nische für sich.

DIAMANTPREISE IM SCHMUCK

Eben haben wir festgestellt, dass Brillanten teurer sind als beispielsweise Baguette- oder Princess Diamanten. Kurioserweise trifft im Schmuck verarbeitet oft das Gegenteil zu: Wenn Sie ein Diamant Armband mit Baguette Diamanten suchen, werden Sie feststellen, dass es erstens wesentlich schwieriger zu finden ist. Und, dass der Diamantpreis pro Karat im Vergleich zu einem Tennisarmband mit Brillanten teurer ist!

Warum ist das so? Zum einen ist die Nachfrage nach Princess, Baguette oder anderer Fantasieschliffe geringer als für Brillanten. Das macht auch die kleineren Steine seltener, weil aus dem Rohdiamanten meist Brillanten hergestellt werden. So wird ein Schmuckstück – in dem Farbe, Reinheit und Größe der Diamanten aufeinander abgestimmt werden müssen – schnell erheblich teurer in der Herstellung.

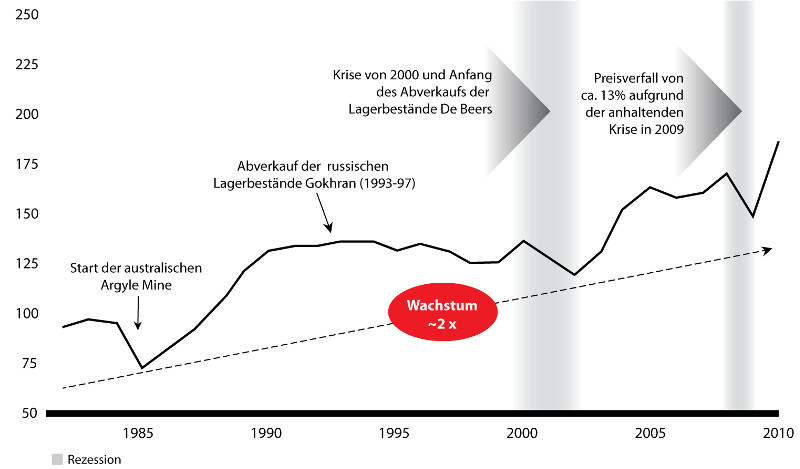

Diamantminen

Ähnlich verhält es sich mit der Entdeckung bzw. Inbetriebnahme von neuen Diamantminen. Mitte der 1980er Jahre hatten russische und australische Minen die Produktion aufgenommen, was die Diamantpreise gedrückt hat. Auf die gleiche Art hat der Abverkauf von De Beers Lagerbeständen ab 2002 die Preise unter Druck gesetzt. Kurz nach der Krise von 2007 hat der russische Diamantproduzent ALROSA seine Produktion nicht heruntergefahren, sondern den Überschuss an den staatlichen Fond Gokhran verkauft. Dadurch hat dieser die größten Diamantbestände weltweit aufgebaut. Wichtiger für die Diamantpreise sind allerdings gesamtwirtschaftlichen Entwicklungen.

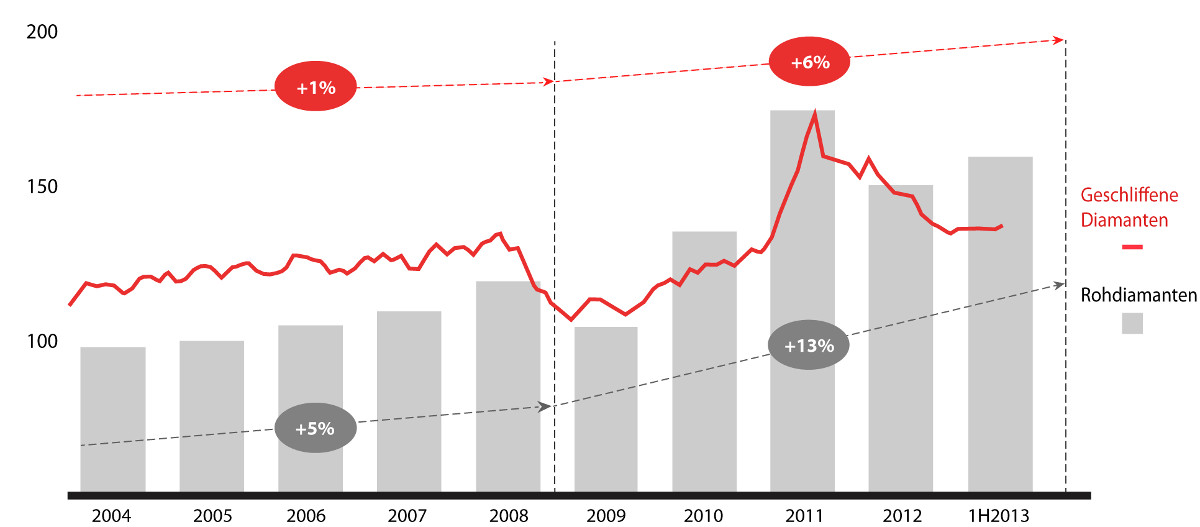

ROHDIAMANTEN

Die durchschnittliche Wertsteigerung von Rohdiamanten beträgt ca. 2% jährlich. Dabei sind die beiden größten Preistreiber gesamtwirtschaftliche Entwicklungen sowie interne Veränderungen der Diamantbranche. Erfahrungsgemäß erholen sich die Diamantpreise von Rohdiamanten nach einer Krise recht schnell. In der letzten Finanzkrise reagierten große Spieler am Markt wie De Beers unmittelbar und verringerten ihre Produktion. Als Ergebnis fiel die Karatproduktion von 175 Millionen in 2006 auf 120 Millionen in 2009.

2% Wachstum pro Jahr (1982 – 2010)

Quelle: DTC Rohdiamanten Index 1982=100, Bain Analyse

Mit freundlicher Genehmigung von Bain & Company

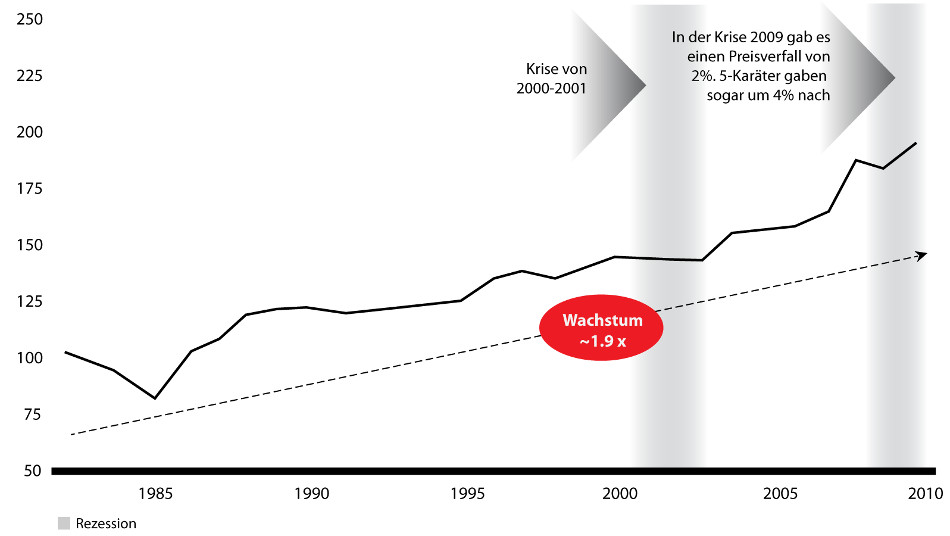

Geschliffene DIAMANTEN

Seit dem Monopolverlust von De Beers haben einzelne Firmen kleinere Bestände in Relation zum Gesamtmarkt und beeinflussen das Marktgeschehen entsprechend weniger. Die Struktur des Marktes ist für Diamantpreise von Bedeutung, da kleinere Marktteilnehmer ihre Inventare eher gering halten. Braucht ein einzelner Händler Liquidität, wird er bereit sein, einen Diamanten aus seinem Bestand günstig zu verkaufen. Insbesondere trifft dies auf geschliffene Diamanten zu.

1,9% Wachstum pro Jahr (1982 – 2010)

Quelle: Rapaport Diamond Index (2011), Bain Analyse

Mit freundlicher Genehmigung von Bain & Company

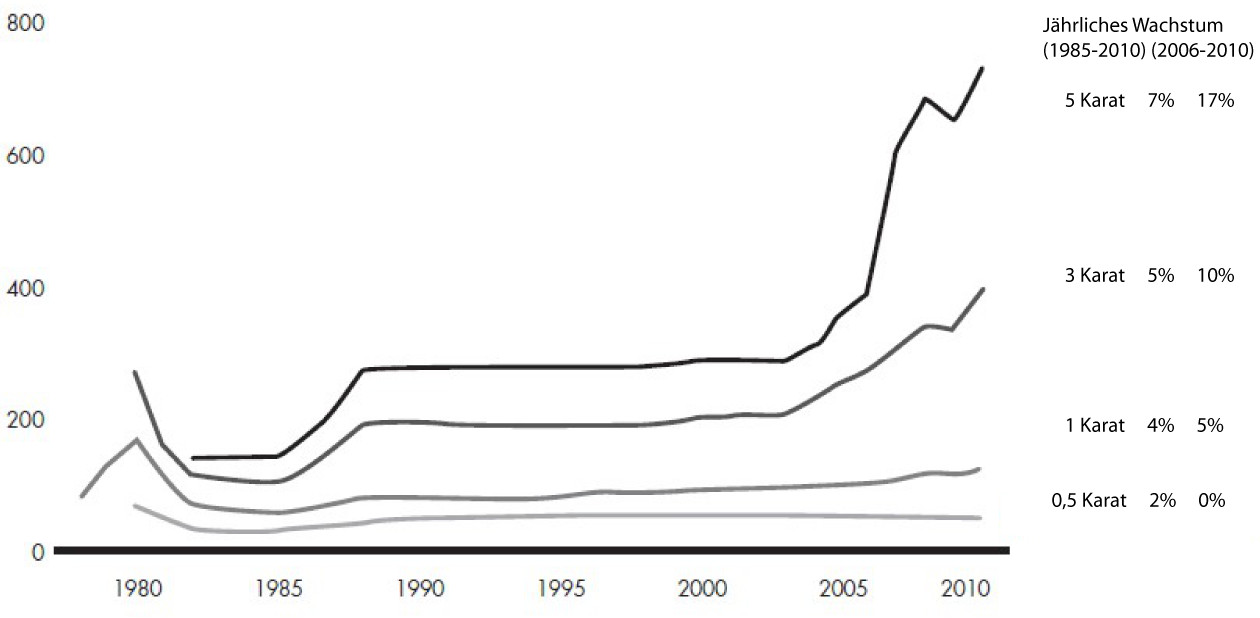

Preisentwicklung nach Karatgröße

Auch hier sieht man die verschiedenen stark ausgeprägten Preisbewegungen. Anhand der Zeittafel wird erkennbar, dass Diamantpreise relativ konstant liegen und wenigen Schwankungen ausgesetzt sind.

Quelle: Rapaport Preis Statistik (2010)

Mit freundlicher Genehmigung von Bain & Company

SYNTHETISCHE DIAMANTEN

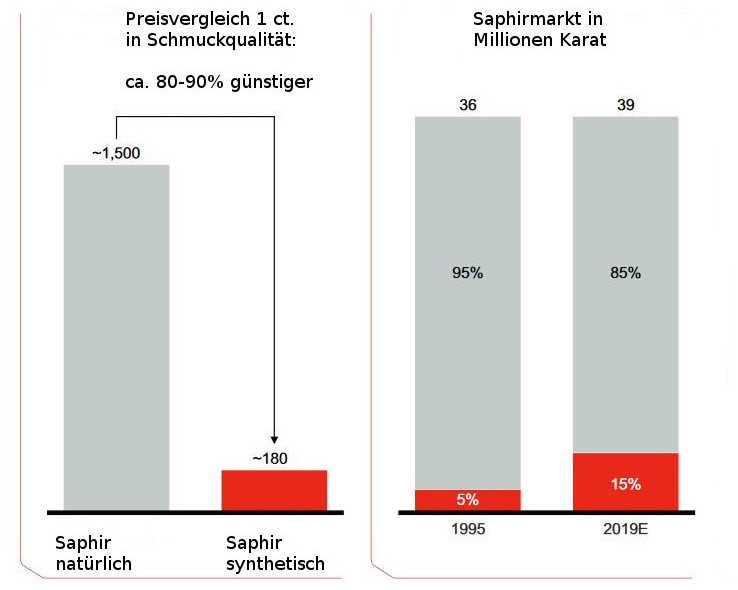

Haben synthetische Diamanten Einfluss auf die Preise von natürlichen Diamanten? Bei Farbedelsteinen gibt es seit jeher einen großen Markt für synthetische Rubine, Saphire oder Smaragde. Viele Schmuckliebhaber wollen einfach einen „roten, blauen oder grünen Stein“ in einem Schmuckstück, das ihnen gefällt – unabhängig von Preis und Seltenheit. Daher geht man von einer ähnlichen Entwicklung am Markt für Diamanten aus.

Ein Zahlenbeispiel zum Vergleich bei Saphiren: Synthesen machen nur ca. 15% des Marktes bei Saphiren aus

Quelle: Preciousgemstones.com, US Geological Survey, expert interviews, Bain & Company. Mit freundlicher Genehmigung von Bain & Company

Die Preise von synthetischen Diamanten werden sich ähnlich wie bei synthetischen Farbedelsteinen voraussichtlich langfristig stabilisieren. So kostet ein synthetischer Moissanit – früher ein täuschend echtes und daher gefürchtetes Diamantimitat – heute ebenfalls immer noch 300 USD pro Karat. Daran hat sich die letzten zwanzig Jahre nichts geändert. Der am häufigsten verwendete Diamant-Ersatz-Stein ist und bleibt Zirkonia. Mit Produktionskosten von gerade mal 1,- Euro erhält man bereits einen funkelnden Stein.

Im Vergleich dazu kosten synthetische Diamanten derzeit ca. 50% eines vergleichbaren natürlichen Diamanten. Viele Juweliere verkaufen diese neuen Schmucksteine gerne, da die Margen meist höher sind als im transparenten Geschäft mit natürlichen Diamanten. Mehr über synthetische Diamanten erfahren Sie auch hier.